By Emeka Nze

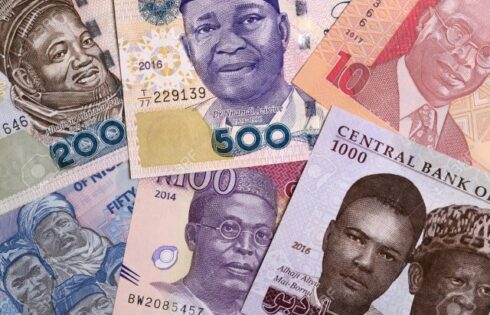

The dire state of the Nigerian economy rather than the unscrupulous actions of forex traders may be responsible for decline in value of the naira.

Since March last year, Nigeria’s central bank governor has devalued the naira three times in an attempt to narrow the gap between the official rate and the widely used parallel market. He started rationing the supply of dollars, but that just drove more people to trade illegally.

It accused money changers in July of aggravating the dollar shortages by selling the foreign currency on the black market. It halted supplies, which usually amount to almost $6 billion a year. The naira fell.

On Sept. 1, the central bank ordered lenders to identify customers buying currency using fake documents and to make their names public in a bid to stifle dollar arbitrage. The local currency continued to decline.

And last week Emefiele forced abokiFX, a platform that tracks the parallel market rate, to stop publishing the gauge. The website’s founder was accused of manipulating the exchange rate for personal gain.

Still the currency lost ground, and the street rate is now at 580 to the dollar, compared with an official rate of about 413 this week.

Emefiele may have to accept that the root cause of the naira’s precipitous decline may not be the unscrupulous actions of traders.

It may instead be the dire state of the Nigerian economy.

-Bloomberg