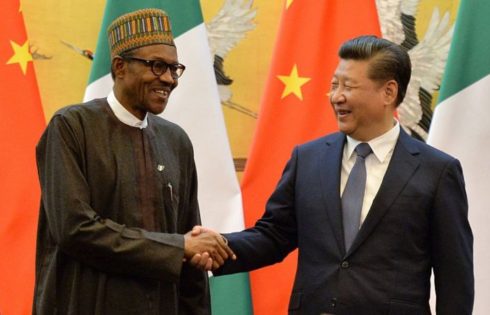

Nigerian authorities have come under persistent fire over their management of loans borrowed from China, which critics argue may burden the public for the coming years.

While Abuja officially says it borrows after planning, critics say China has been lumping Nigeria with deep debt to target the west African country’s assets in case of default in the future.

It started on May 19, this year after Dr Bongo Adi, the Director of Centre for Infrastructure Policy Regulation and Advancement (CIPRA) at the Lagos Business School, warned that Nigieria “Nigeria lacks accountability, transparency, and responsibility to refund its loans.”

Then Mr Atiku Abubakar, Nigeria’s two-time Vice-President and later main opposition to President Muhammadu Buhari in 2019 presidential election, lashed the government for redirecting what he argued was lean resources to debt servicing, a worrisome situation that the country may slide into trouble waters of its creditors.

The fears also prompted the House of Representatives to direct its committees to investigate all China-Nigeria loan agreements from 2000 to date.

The intention is to ascertain the viability of the facilities, the legislatve body said, and then regularise and have them renengotiated, especially as the country is expected to slide into recession this year due to effects of coronavirus.

Mr Ben Igbakpa, a legislator, moved a motion on July 20, 2020 to review and renegotiate existing China-Nigeria loan agreements in other to avert falling into the pranks of China.

Although there seems to be cause for concern as Nigeria’s economy is becoming highly dominated by the China, officials say the status of the loans from China, though high, is still within Nigeria’s ability to repay.

According to the Debt Management Office (DMO), a government’s agency in-charge of managing the nation’s loans, as at July 2, 2020, the total loan agreement with China stood at $3.121 billion, although the Asian country has disbursed $3.31250 billion. That represents 3.94 percent of Nigeria’s domestic and external debt of $79.3 billion.

DMO said China accounts for 11 percent of Nigeria’s external debt. But China is still the biggest bilateral lender in Nigeria, with most loans being concessional.

Besides China, Nigeria is indebted to the International Development Association (IDA) to the tune of $9.68 billion, African Development Bank (AfDB), $1.3 billion, and $10.86 billion from Eurobonds.

According to records, Nigeria has paid principal of $192.21 million leaving an outstanding of $3.121.29 billion which is repayable to China at most for 20 years with interest of $269.6 million.

Officials say are no reasons to panic as the Chinese loans are properly utilised for critical projects, many of which had been completed and others in advanced stages of completion.

The projects include the public security communication system, Idu-Kaduna railway modernisation which had been completed as well as the ongoing Abuja light rail project.

Others are ICT Infrastructure Backbone, airport terminal expansion in Abuja, Kano, Port Harcourt and Lagos, Zungeru Hydroelectric power project, 40 parboiled rice processing plants, Lagos –Ibadan railway modernisation project and upgrading of Abuja-Keffi-Makurdi road.

The loans are also being used to service the supply of rolling stocks and depot equipment for Abuja light rail project as well as greater Abuja water supply project.

DMO reported that borrowing from China is based on needs, and subject to the receipt of requisite approvals, to finance capital projects, in order to promote economic growth and development, as well as, job creation.

The biggest question, however, is whether China’s loans agreements can be available for scrutiny or if their conditionality can be listed in public. Beijing often cites parties’ confidentiality to decline revelations.

Nigeria though says it has alternative access to credit such as the World Bank and the African Development Bank, as well as, bilateral loans from various countries such as France, Germany, Japan, India, and China.

“Prudent management of the public debt implies that, the government should avail [sic] itself of the opportunity to access concessional loans which deliver twin benefits of being more cost efficient and supporting infrastructural development,” DMO said in a bulletin recently.

“Loans from Concessional Lenders have limits in terms of the amounts that they can provide to each country. This makes it necessary for Nigeria to have several sources for accessing concessional capital to increase the total amount available and also, to avoid undue dependence on only a few sources of concessional funds.’’

Still, Abuja says it has a perennial infrastructure deficit that only China has tried to plug. Nigerian government officials have recently embarked on fighting off probes into debt management.

Transport minister Rotimi Amechi warned on July 28 that investigations into loans taken by the government could send wrong signal to the lenders.

Ameachi made the observation at an investigative hearing organised by the House of Representatives Committee on Treaties, Protocols and Agreements in Abuja. He said that the investigation could cause foreign partners to withdraw such loan facilities which have negative effect on Nigeria’s infrastructural development.

Minister of Information and Culture, Mr Lai Mohammed, also replied critics, that Nigeria is confidently meeting its loan obligations.

The minister explained that the debt service provisions is made in the annual budgets including principal repayments, interest payments and all other applicable charges.

He said based on budgetary provision and the payments, the issue of creditors foreclosing on Nigeria as predicted by naysayers, including Abubakar, did not arise.

-theeastafrican