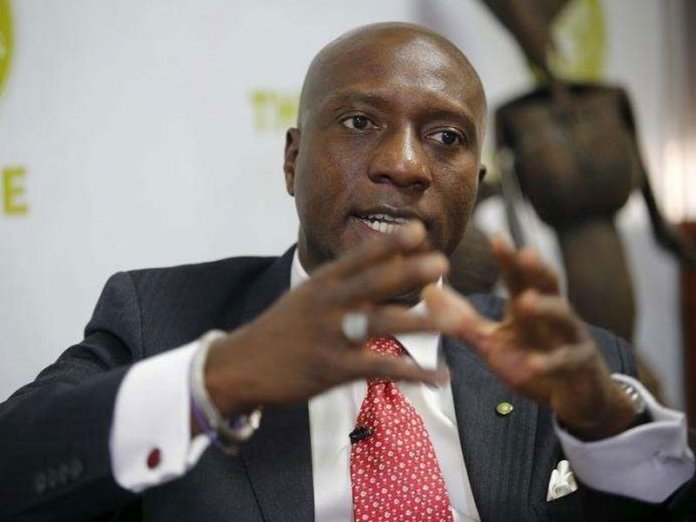

The Chief Executive Officer of the Nigerian Stock Exchange (NSE), Mr. Oscar Onyema, yesterday restated the Exchange’s commitment to providing corporates and investors access to market in meeting their financial and investment needs during this period and beyond.

Onyema said this during the first-ever digital closing gong ceremony hosted via Instagram Live, in honour of the contribution of Sterling Bank Plc to the fight against the COVID-19 pandemic in Nigeria.

“Following the activation of our Business Continuity Plan and our transition to remote working and trading, The exchange has been resolute in its commitment to ensure that there are no disruptions to operations for any of our stakeholders.

“We have leveraged our existing digital assets to ensure there is continuous flow of information and activity in the market and are now looking at how we can deploy creative solutions to enhance our stakeholders’ experience during these unprecedented times,” he said.

According to him, the sounding of the closing gong to mark the end of the trading day as a treasured tradition of the NSE that has been impacted by the temporary closure of the trading floor was one that presents an opportunity for digital engagement.

“It has been our pleasure to rekindle the tradition of sounding the closing gong albeit digitally with Sterling Bank Plc. It would be remiss of me not to thank the Mr. Abubakar Suleiman (chief executive officer of Sterling Bank) for joining us to achieve this milestone and commend him for the notable efforts Sterling Bank is making to curb the spread of COVID-19 in Nigeria and support the Nigerian economy at this time,”Onyema said.

On his part, Suleiman, commended the NSE for leading the digital transformation of the market.

“These are interesting times we live in with the outbreak of Coronavirus changing the way we live and work. While we all come to terms with these new realities, I urge everyone to identify and leverage the opportunity we have been given to reset our nation and our businesses.”

He said the bank was offering a range of solutions to help Nigerians manage through temporary or extended periods of reduced or lost income as a result of the Coronavirus outbreak.

“We have reduced the restructuring fees on all new and existing loans by up to 50 percent; issued an extension of the repayment of loan obligations that are due; and suspended the penal charge for late minimum repayment on customer credit cards during this period; to name a few,” Abubakar said.